If your family is eligible for the 2021 child tax credit, you have the option to decide if you want to receive advance payments or not. The default is to receive the advance payments. You also have the option to opt out. If you opt out, you will still receive the full tax credit. It will just be received in a lump sum when you file your 2021 tax return.

Please note: if you decide to opt out and you are married filing joint, both spouses need to opt out individually.

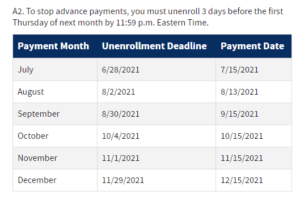

Letters are being mailed out now notifying families who may be eligible for the payments. Instructions on how to opt out are now available on the IRS website. The deadline to opt out for the July payment is June 28. If you miss that deadline, you can still opt out of future payments. Here are the deadlines for each month’s payments:

Letters are being mailed out now notifying families who may be eligible for the payments. Instructions on how to opt out are now available on the IRS website. The deadline to opt out for the July payment is June 28. If you miss that deadline, you can still opt out of future payments. Here are the deadlines for each month’s payments:

How does the advance child tax credit work?

Advance payments are half of the child tax credit. The maximum annual credit is $3,000 for qualifying children ages 6 through 17. It’s $3,600 for qualifying children under age 6. The age is determined as-of the end of 2021.

The advance payments will be sent out monthly beginning in July. For example, if you have 2 children in the 6 – 17 range, your total child tax credit is $6,000. Half of that will be advanced, so you would receive $500 per month July – December.

You can receive the maximum credit if your modified adjusted gross income is:

- $75,000 or less for single taxpayers

- $112,500 or less for head of household

- $150,000 or less for married couples filing jointly and qualifying widow(er)s

- The maximum credit phases out for incomes over this level

The IRS is basing the advance payments on your 2020 tax return, or 2019 if the 2020 isn’t filed yet. When you file your 2021 tax return, the actual amount for which you’re eligible will be calculated. If your income is higher in 2021, it’s possible you could have to pay back some of the payments received.

There are other specifics about the program including more details on who’s eligible. For more information, go to irs.gov.

Why should you opt out of the advance child tax credit payments?

The decision to opt out really depends on your need for the funds and how you will use them. If you are in a job transition or suffering other financial hardship as a result of COVID-19 or other causes, it clearly makes sense to accept them. However, if your financial situation is secure, opting out bears further consideration.

If your financial situation is secure, the decision should be based on how you would use the money. In theory, getting money sooner rather than later is better financially. But that’s only if the money is used to improve your long term finances. If you’re going to apply 100% of the money to build your emergency fund, pay down debt, or save for the future, it’s great to receive it through the advance payments. You can set up automatic monthly contributions or transfers to these goals based on the amount of your payment.

If you are concerned that the advance money might be spent on less beneficial purchases, it may make more sense to opt out. If you opt out, you will receive the full tax credit in a lump sum. For many people, it’s easier to make a significant long-term choice with one larger amount than a series of smaller payments.

So, you need to know yourself. Are you likely to be disciplined with the monthly payments and turn them into a high-impact benefit for your family’s future? Or do you set yourself up for more success by deferring the advance payments to receive the larger lump sum when you file your 2021 tax return? To defer, please visit irs.gov/childtaxcredit2021. If you’re going to receive the monthly payments, make your plan now on what you will do with them.

You may also want to consider opting out if:

- You expect to not qualify for the credit based on your actual 2021 income. In that case, declining the advance payments would avoid the need to repay them when filing your 2021 tax return.

- You based your federal tax withholding on receiving the full tax credit when you file. In this case, you may owe if you receive the payments in advance.

Please feel free to reach out to us for specific questions related to your situation.

This blog post was updated based on the most current information as of June 27, 2021. It was updated again on July 15 to address additional questions.