Many of our clients plan to leave part of their estate to charity and part of it to individual people. If this is one of your goals, you can maximize the value of your gift by thinking about income taxes. Tax-efficient beneficiary designations allow your gifts to go the farthest.

Many of our clients plan to leave part of their estate to charity and part of it to individual people. If this is one of your goals, you can maximize the value of your gift by thinking about income taxes. Tax-efficient beneficiary designations allow your gifts to go the farthest.

Designating all of your accounts and assets with the same percentages and beneficiaries across your entire estate is the most common approach. However, that is not the most tax-efficient method. Part of your legacy may unnecessarily go to income taxes with this approach. Charities don’t pay taxes on the gifts received. People will be taxed on parts of the inheritance, depending on the type of asset.

Here’s the order from best to worst of assets to leave to people:

- Roth IRAs — because the beneficiary can continue to benefit from tax-free growth for 10 years beyond death

- Assets that will receive a step-up in basis on death — securities in taxable accounts, real estate, etc.

- Non-qualified annuities – part of this inheritance (the earnings) will be subject to regular income tax for the beneficiary; part (the original contributions) will not be taxed

- Traditional and rollover IRAs and qualified plans (401ks, 403bs, etc.) – all pre-tax accounts will be subject to regular income tax to the beneficiary and need to be distributed over 10 years

The list of the best assets to leave to charity goes in the opposite order. You would start by designating charities as full or partial beneficiaries of your pre-tax accounts. If your charitable intent is greater than your pre-tax balance, you would next do any non-qualified annuities. Then you would proceed to taxable accounts, with Roth IRAs as the absolute last option for charitable bequest.

An example of tax-efficient beneficiary designations

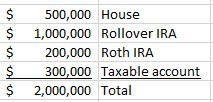

Let’s say this is your estate:

Say you want 50% of your estate to go to your children and 50% to go to charity. In that case, we would recommend naming the charities as beneficiary of your rollover IRA and naming your kids as beneficiary of the house, Roth IRA, and taxable account. With this tax-efficient approach, your kids will actually receive $1 million after-tax. The charity will actually receive $1 million from the IRA because they don’t have to pay taxes on the IRA income.

Say you want 50% of your estate to go to your children and 50% to go to charity. In that case, we would recommend naming the charities as beneficiary of your rollover IRA and naming your kids as beneficiary of the house, Roth IRA, and taxable account. With this tax-efficient approach, your kids will actually receive $1 million after-tax. The charity will actually receive $1 million from the IRA because they don’t have to pay taxes on the IRA income.

You can contrast our tax-efficient recommendation with the most common method where you just name your kids and the charity as 50/50 beneficiaries on everything. In this case, we’ll assume the IRA distributions occur in the 24% tax bracket (this will vary a lot based on your beneficiaries’ tax situation). With this most common scenario, your kids only receive $880,000 because of the taxes they need to pay on the IRA asset distributions. They will be subject to federal income tax on their half of the rollover IRA. The charity still gets $1 million. And an unnecessary $120,000 goes to federal income taxes (24% x $500,000)*. You can see why we recommend paying attention to this, right?

Coordinating with your attorney and financial planner

It’s important to coordinate your beneficiary designations with your will or trust. IRAs will typically pass with beneficiary designations, and these designations override anything that’s in your will. The taxable account and any real estate are typically held in trust or pass to heirs through the will. Discussing your wishes and plans with your attorney and financial planner is important to make sure it’s well-executed.

In the example above, you would potentially be naming your kids as the 100% beneficiary of your trust or will and not mentioning the charity at all. The trust or will would leave the house and the taxable account to your kids. Then, you would list the charity as the 100% beneficiary of your rollover IRA and your kids as the 100% beneficiary of your Roth IRA with the custodian. If you’re married, these might be contingent beneficiary designations after the second spouse is deceased.

There’s also a tremendous amount of flexibility. Say you wanted 10% of your estate to go to charity rather than 50%. With the assets above, you could name charity as the 20% beneficiary of your IRA ($200,000) and your kids 80% ($800,000). Then leave 100% of everything else to the kids. You’re still using the asset with the highest tax burden to satisfy your charitable intent.

Simplifying the logistics of tax-efficient beneficiary designations

If you have more than one charitable beneficiary or want to update your charities frequently, you may want to consider using a foundation to disperse the IRA proceeds to your charities. With this approach, you would name the foundation as the beneficiary on your IRA, and keep your donor recommendations on file with the foundation. You are then free to list as many organizations as desired and to update your beneficiaries and percentages as often as desired with the foundation. On your death, the foundation receives the portion of the account designated to them and disperses it to the charities you specified. This service is a helpful way to simplify the account administration on death. There are typically fees for this service, and you should research these before designating the foundation as your beneficiary to ensure they seem reasonable.

We love hearing about your goals and desires and coming up with a plan to fulfill your plans most tax-efficiently. If we can help, please Contact Us.

*We simplified the tax calculations and IRA pay-out requirements significantly for ease of illustration. Just letting you know that we know that there’s a lot more to it.