I encounter many questions and discussions with clients on whether gold belongs in a portfolio. The following article from Dimensional Fund Advisors takes an in-depth look at gold’s long-term performance and is worth reading as you consider this issue.

Is Gold Worth It’s Weight in a Portfolio?

Shared with permission of Dimensional Fund Advisors

During a weak global economy and uncertain financial markets, many investors tout the benefits of holding gold. Some proponents claim that gold deserves a significant weighting in most investors’ portfolios. Gold’s often-cited portfolio benefits include a strong long-term return, a hedge against inflation, and safe haven during turbulent times.

But does the evidence build a case for holding gold as a separate asset class? Let’s look at historical returns for the answers.

Gold’s Long-Term Performance

Investors who think of gold as having strong long-term returns base their belief on two strong performance periods in the past four decades—the most recent decade and the 1970s. These periods account for most of gold’s price appreciation.

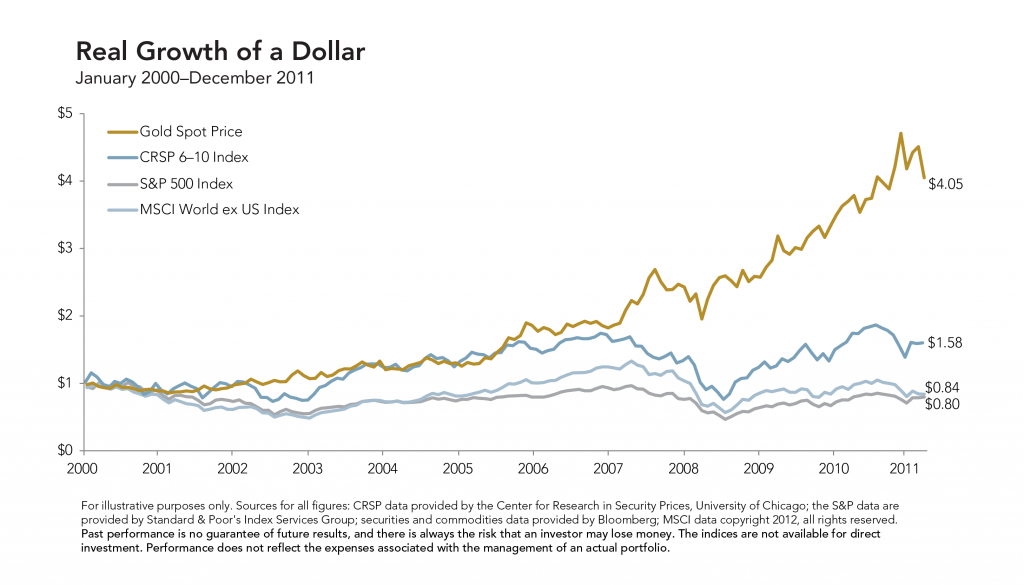

Figure 1 documents gold’s strong performance since 2000. After hitting a twenty-year low in 1999, gold began a steady climb in the wake of the dotcom bust, stock market downturn in 2001, and the 9/11 attacks. As the decade wore on, there were Wall Street scandals, natural disasters around the world, and record oil prices. Gold’s strongest performance period has come since 2008—and investors can still recall the emotional and financial stress that came with the mortgage meltdown, volatile financial markets, and worldwide recession.

From 2000 through 2011, gold outperformed major equity asset classes around the world. In terms of real (inflation adjusted) growth, gold turned a dollar investment into $4.05, and US small cap stocks (as represented by the CRSP 6-10 Index) turned a dollar into $1.58, while the S&P 500 Index and MSCI World ex US Index lost value. Gold had a 12.3% annualized real return, versus -1.88% for the S&P 500 Index, -1.4% for the MSCI World ex US Index, and 3.9% for the CRSP 6-10 Index.

Figure 1:

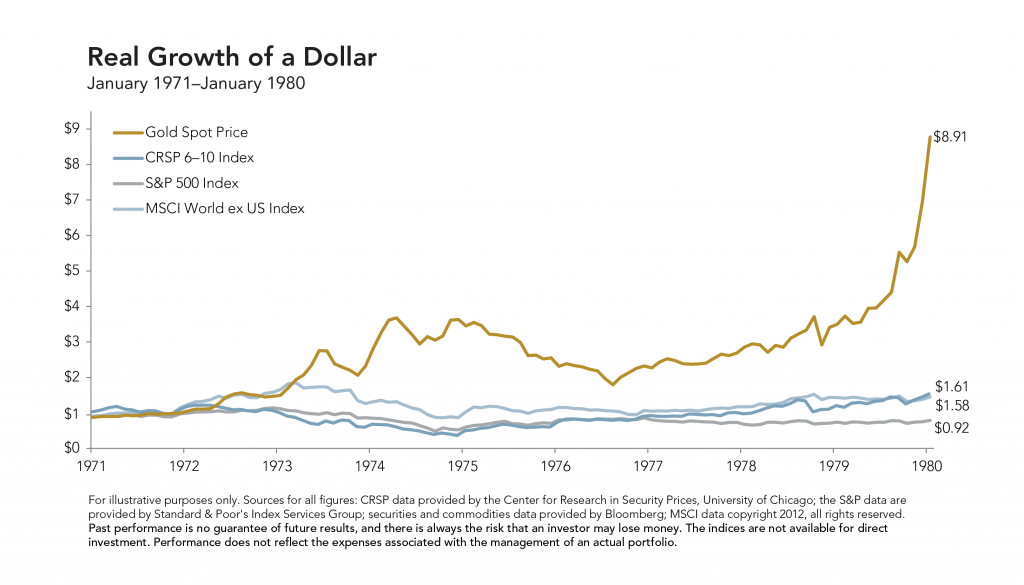

Now let’s step back in time to the other strong decade for gold—the 1970s. Figure 2 documents gold’s performance relative to equities after the US dropped the gold standard in 1971. A dollar of gold in 1971 appreciated to $8.91 in real terms by January 1980, when it peaked at $850 per ounce, returning over 27% a year and far surpassing the performance of other asset groups.

Figure 2:

However, much of this rapid appreciation occurred under special circumstances in which US investors could not benefit directly.

Here’s why: In August 1971, President Nixon took the US off the gold standard, and the price was reset to $38 an ounce. In 1973, the US government decoupled the dollar’s value from gold, and the price was allowed to float freely. During 1974, the price of gold quickly shot up to $120 per ounce in the free market. Beginning in 1975, the government removed ownership restrictions and US citizens were free to directly own gold for the first time since 1933.

So, US investors could not participate in gold’s price appreciation during the first half of the 1970s, and if you disregard those early performance years, gold loses much of its glitter. From 1975 through 1980, a dollar invested in gold grew to only $2.37 (versus $8.91), reflecting an 18.4% annualized real rate of return—considerably less than the 27% return for the entire decade. Compare this performance with a 28.9% real annualized return for US small cap stocks (CRSP 6-10 Index), 6.9% for the S&P 500, and 9.4% for non-US stocks ( MSCI World ex US Index) for the shorter period.

Some investors who are old enough to remember the 1970s associate the higher demand for gold with turbulent times. The decade was marked by political unrest, war, the 1973–74 bear market, two worldwide oil shocks (1973 and 1979), stagflation, Middle East conflict, and Cold War tensions. In some ways, the 1970s resembled the first decade of this century.

Viewed in isolation, the periods suggest that gold offers a reliable source of returns during economic and market distress. But the details show that rising demand for gold in the US was due not only to economic uncertainty, but also to changing monetary policy and federal legislation regarding individual ownership of bullion.

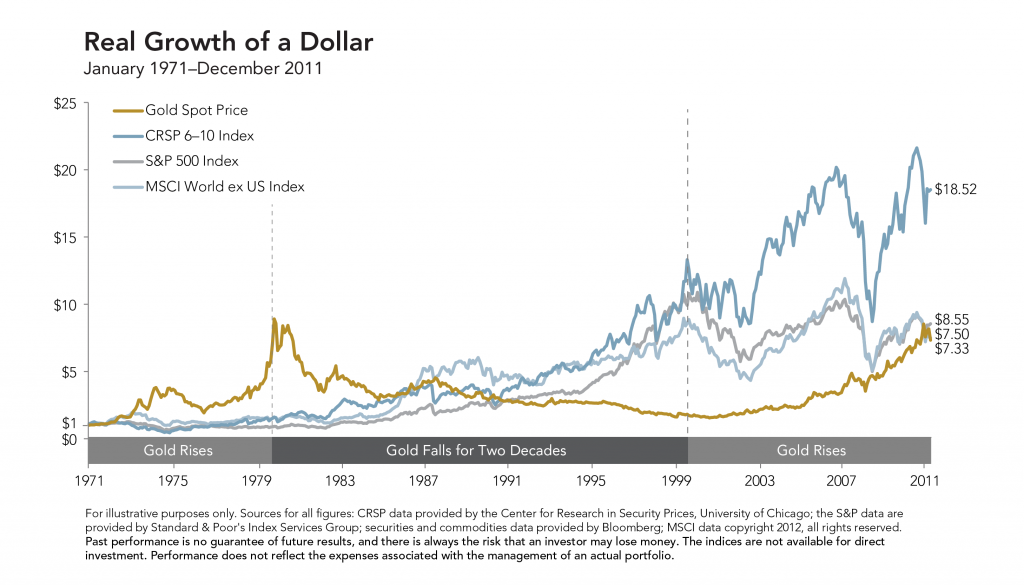

Fortunately, times eventually improved—and from a broader historical perspective gold has not delivered the long-term performance that some investors imagine, especially during more stable economic periods. Figure 3 documents the real growth of a dollar invested in gold and equities over the entire period—from 1971 through 2011. Gold has provided lower inflation-adjusted growth than other assets ($7.33 per dollar invested) and a lower average return—4.9% per year versus 5.3% for the S&P 500, 5.0% for non-US stocks, and 7.3% for US small cap stocks.

Figure 3:

If one disregards the 1971–1974 period when US investors could not own it directly, gold’s long-term performance drops substantially. From 1975 through 2011, gold produced a real annualized return of only 1.82% and grew an invested dollar to only $1.95 (versus the $7.33 shown above). US small cap stocks returned 10.6% ($41.73), the S&P 500 returned 7.1% ($13.07), and non-US stocks returned 5.5% ($7.49).

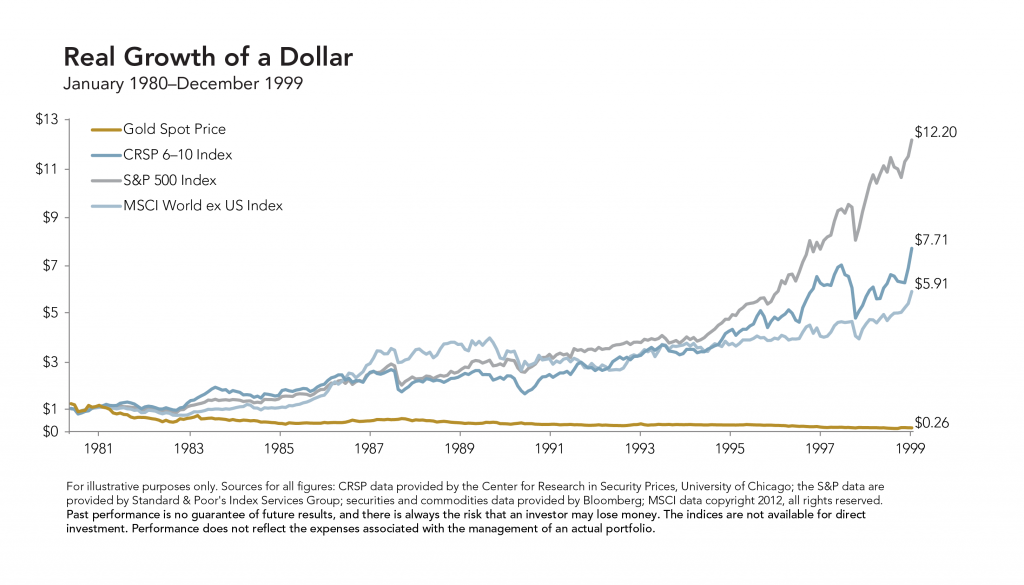

Now let’s consider the twenty years between gold’s two high-performance periods in the 1970s and 2000s. Figure 4 shows growth of a dollar for the same asset groups from 1980 through 1999, during gold’s period of extreme underperformance. Those decades are generally known for global economic expansion and positive stock market returns. Yet, gold delivered a -6.5% annualized return, compared with 10.7% for US small cap stocks, 13.3% for the S&P 500, and 9.2% for non-US stocks (MSCI World ex US Index).

A dollar invested in gold dropped to 26 cents in real terms, while the other assets grew substantially.

Figure 4:

So, from a long-term perspective, gold has not experienced a reliable or sustained rise in value. In fact, its price appreciation has been limited to unpredictable, isolated episodes of high demand. Investors who attempted to time these episodes exposed their wealth to potentially higher risk and to the opportunity cost of missing out on stock market growth.

Gold as an Inflation Hedge

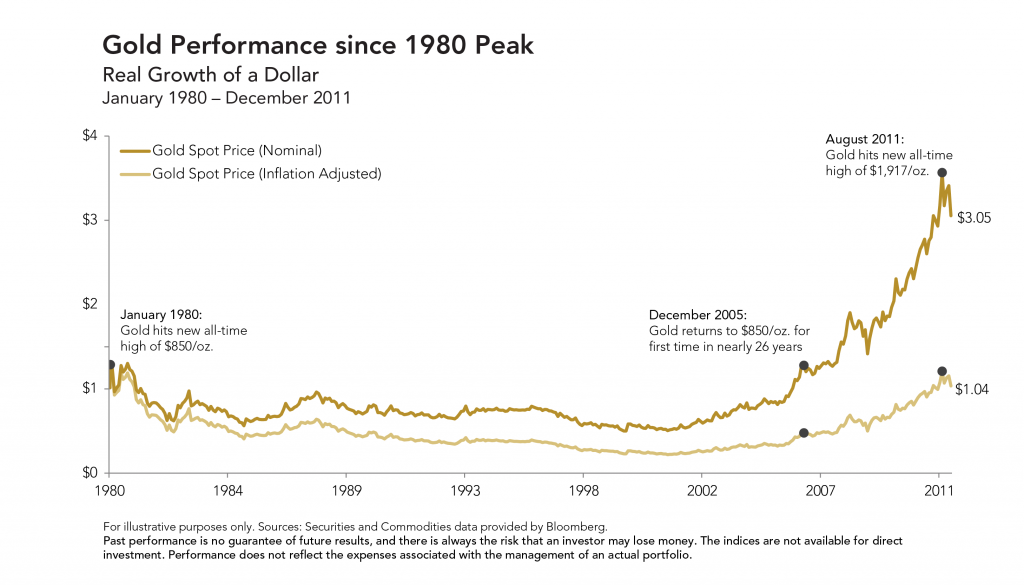

Some investors perceive gold as a good hedge against inflation and point to its recent record prices as evidence. Figure 5 below shows gold’s performance in nominal and inflation-adjusted terms from its price peak in 1980 through 2011. Gold’s price has climbed substantially in nominal terms. But when adjusted for inflation, a dollar of gold in 1980 was worth $1.04 at the end of 2011.

Figure 5:

Of course, gold’s performance relative to inflation has varied according to the time frame measured. In some periods, gold has outperformed inflation, while in other periods gold has failed to match it. For example, from 1970 through 2005, consumer prices more than doubled while gold lost 20% of its value.1 Gold’s unreliable performance relative to inflation also comes with much higher volatility. Since 1970, its standard deviation has been over 19%, compared with 1.2% for the Consumer Price Index (CPI).2 By this measure, gold is over fifteen times more volatile than the CPI.

Gold as a Portfolio Diversifier

Proponents also claim that gold offers a portfolio diversification benefit due to its low historical correlation with stocks. (Correlation measures how closely two securities or asset groups perform relative to each other over a given time period. 3) This may be true when gold is held as an incremental part of a broader diversified commodity strategy within a portfolio. But correlation is not the only factor to consider in diversification. Volatility also matters, and history shows that, while gold has a long-term return similar to the S&P 500 Index, its volatility approaches that of US small value stocks, an asset class that historically has demonstrated a higher average return for the higher risk. So, holding gold as an asset class can make a portfolio considerably more volatile, which may offset the potential benefit of low correlation.

Also, according to modern financial principles, the components of a portfolio should have an expected return. As a material input, however, gold does not offer the potential for generating income or earnings. Its only source of return is price appreciation caused by shifting supply and demand. As shown in historical performance, price appreciation is not a certainty.

These characteristics make gold a speculative asset, like currency or collectibles. If you put gold in a vault and wait a few decades, it will not produce anything, and its value will reflect the current spot market price. In fact, holding physical bullion may incur negative cash flows due to storage, insurance, and other costs. In contrast, a stock reflects ownership in a business enterprise that seeks to generate profits and produce more wealth. Investors who put their capital to work in the economy expect a potential return from cash flows and appreciation.

Summary

The evidence raises doubt about gold as an essential component in a portfolio. Over time, gold has not delivered significant growth relative to equities. While in real terms gold has preserved its value, it may not closely track inflation over shorter time periods. Moreover, gold’s early and recent performance should not obscure the two decades in which it depreciated considerably. Finally, gold is more volatile than other asset groups and does not generate positive cash flows, reducing its potential benefit as a portfolio stabilizer.

Famed investor Warren Buffett aptly summarized gold’s speculative nature, non-productive quality, and high opportunity cost in a Fortune article in February:

Today, the world’s gold stock is about 170,000 metric tons. If it were all melded together, it would form a cube of about 68 feet per side (fitting within a baseball infield). At $1,750 per ounce, it would be worth $9.6 trillion.

With the same amount of money, you could buy all US cropland (400 million acres with output of $200 billion annually) plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually), and still have about $1 trillion in cash.4

Some investors may prefer to hold a modest measure of gold in their portfolio, if only to feel better about uncertain times, or to include gold as one of several components in a broader commodity strategy. But they should think hard before concentrating a large part of their wealth in it.

Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services.

Dimensional Fund Advisors LP is an investment advisor registered with the US Securities and Exchange Commission.

Notes

- Francesco Guerrera, “A Golden Age for Gold Loses Some of Its Luster,” Wall Street Journal, October 4, 2011.

- Standard deviation is the statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution.

- Correlation is computed into what is known as the correlation coefficient, which ranges between ‒1.0 and +1.0. Assets that have negative correlation tend to move in opposite directions, while assets with positive correlation have more similar performance. A zero correlation indicates no relation in performance. From 1971 to 2011, gold had a slightly negative long-term correlation with the US large cap stocks (‒0.001) and one-month US T-bills (‒0.07), and low correlation with US small cap stocks (+0.022). Correlation with non-US stocks was moderately positive (+0.21).

- Warren Buffett, “Why Stocks Beat Gold and Bonds,” Fortune, February 9, 2012.