The answer will probably be surprise you.

You’ve likely noticed that the U.S. stock market has offered booming returns over the past three or four years: up an average of 17.4% in the past 36 months alone. Then you look at the money invested in international equities (the EAFE index up just 8.7% a year), bonds (the Barclay’s Aggregate Bond Index up 2.5% a year), and just about any other sector you could name, and it looks like they were holding you back.

Wasn’t that a huge opportunity cost in diversifying away from U.S. stocks? Didn’t you lose money not being in U.S. stocks all that time?

Surprisingly, the answer is no. In fact, a recent article in the Journal of Financial Planning offers a neat illustration showing why diversifying in a variety of assets–even though some inevitably underperform others–can actually raise your total portfolio returns over the longer term.

The article starts by pointing out the fact that positive and negative returns are not equal. For small losses, they’re close: a 10% decline requires an 11% gain in order to get back the money you lost. If you lose 20%, you have to gain back 25% before you have what you had before the market took a bit out of your portfolio.

But what if you lose 30%? Now you have to get back 43% in order to have what you started with.

Lose 40% of your portfolio value, and you aren’t whole until you get a whopping 67% return on the remaining assets. Lose 50% and, of course, you need a 100% return to get back to where you were.

The point? If diversification minimizes extreme portfolio movements in either direction, it can lead to greater wealth creation–just because of the mathematics of gains and losses.

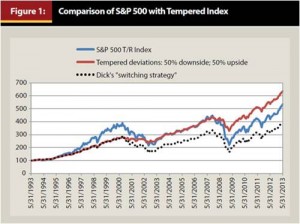

To illustrate this, the authors produced an interesting chart. They plotted the S&P 500’s returns from mid-1993 through mid-2013, which includes the thumping, roaring bull market of the later 1990s and two rather nasty market pullbacks. Then they assume that somehow you would be able, via a broad asset mix, to reduce the downside by 50% and also give up 50% of every upside in the index–an even trade, right?

To illustrate this, the authors produced an interesting chart. They plotted the S&P 500’s returns from mid-1993 through mid-2013, which includes the thumping, roaring bull market of the later 1990s and two rather nasty market pullbacks. Then they assume that somehow you would be able, via a broad asset mix, to reduce the downside by 50% and also give up 50% of every upside in the index–an even trade, right?

In fact, this strategy doesn’t look so great during the booming late 1990s, when the “tempered” index returns fell behind the market returns. But over time, due to its outperformance during market busts, the tempered market returns produced more terminal wealth than the index itself.

Then the authors looked at what would happen if an investor did what many investors today are probably thinking about doing: abandoning those tempering, underperforming “other” investments and going all in on U.S. stocks. They create a hypothetical investor named “Dick” who became very impatient watching his tempered portfolio underperform the index for the first seven years of the chart as the bull market roared through the investment world. So he made a bold decision: Banish diversification! Full speed ahead with U.S. stocks! He switched to the U.S.-only portfolio, and, as you can see on the graph, he has underperformed ever since.

Article adapted with permission of Financial Columnist Bob Veres. The full study is available at http://www.fpanet.org/journal/RiskManagementasAlphaGenerator/